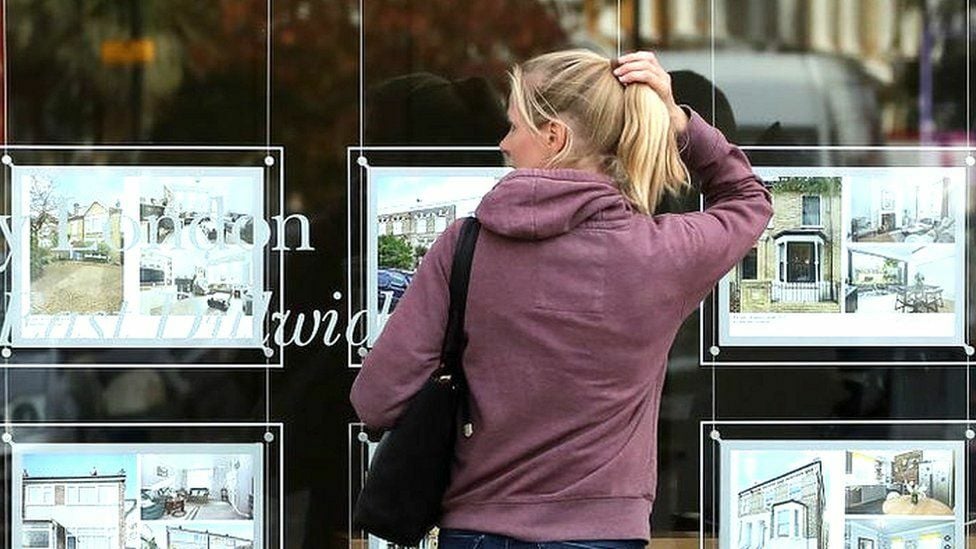

Mortgage deals vanish as rates surge amid inflation fears

The average cost of a two-year fixed-rate mortgage has risen by £35 per month in recent weeks, according to financial data firm Moneyfacts. This increase is attributed to a 0.3% rise in interest charges, following inflation data that did not decline as rapidly as anticipated. Consequently, many experts predict that the Bank of England may raise interest rates more than initially expected, potentially reaching 5.5% from the current 4.5%.

As a result, numerous lenders have increased mortgage rates and withdrawn deals from the market. Over the weekend, several lenders altered their mortgage offers, which is likely to further strain household and business budgets. On Friday, TSB removed all of its 10-year fixed-rate deals with less than three hours’ notice, though the bank claimed the move was temporary. Meanwhile, Santander’s new business mortgage rates increased between 0.05% and 0.43% on Monday, and Coventry Building Society is set to raise its two-, three-, and five-year deals on Tuesday.

Moneyfacts reports that the average two-year fixed rate on a £200,000 mortgage over a 25-year term now stands at 5.64%, compared to 5.34% before the latest inflation data. The Bank of England has been gradually raising interest rates over the past 18 months in an effort to combat soaring prices.

Sarah Coles, head of personal finance at Hargreaves Lansdown, warned that millions of people are now facing a “remortgage nightmare.” She explained that those on fixed-rate mortgages have been protected from rate hikes thus far, but will soon be exposed to the full impact of the increases when their deals expire.

Inflation, which measures the rate at which prices are rising, has surged over the past 18 months due to skyrocketing food and energy costs. Last month’s data revealed that the inflation rate dropped to 8.7% in the year to April, down from 10.1% in March but still above the anticipated 8.2% figure.

Last week, Nationwide cautioned that further rises in mortgage interest rates could negatively impact the housing market. The building society’s warning came as its latest data showed that UK house prices fell at their fastest annual rate in almost 14 years in May. Nationwide also noted that “headwinds to the housing market look set to strengthen in the near term.”

While a decline in house prices would typically benefit first-time buyers, the increase in interest rates means that mortgage costs are now higher than many prospective homeowners may have budgeted for.

Latest Thailand News

Follow The Thaiger on Google News: