Search Results for: interest rates

- Business News

CIMB promotion offers increased interest rates for saving accounts

CIMB Thai is offering a new range of savings accounts with increased interest rates until the end of July. Beginning on June 1, CIMB Thai customers who open a ‘Speed Savings Account’ will receive an increased bonus interest rate to help grow their savings. Each savings account will receive a base interest rate adjusted based on the total amount of…

- Thailand News

US offers lower interest rates on F-16s jets to sway Thailand

The United States proposed lowering the interest rates for the Royal Thai Air Force (RTAF) to purchase F-16 fighter jets in a bid to persuade the Thai government to choose American-made aircraft over Sweden’s Gripen jets. According to a Defence Ministry source, this offer follows the RTAF’s recent announcement that it is considering the Gripen jets, following a procurement committee…

- Business News

Finance Minister, Central Bank Chief to discuss interest rates

A crucial meeting is scheduled tomorrow between Finance Minister Pichai Chunhavajira and Bank of Thailand Governor Sethaput Suthiwartnarueput to address the prevailing contention over interest rates. The government, under Prime Minister Srettha Thavisin’s directive, has been advocating for a rate reduction to stimulate the economy. In contrast, the central bank has maintained its key rate at the highest in ten…

- Business News

Thai economy falters as high interest rates impact major sectors

The Thai economy has taken a hit, with government revenue collections falling short of the target. Lavaron Sangsnit, the permanent finance secretary, attributed the shortfall to high interest rates, which have significantly reduced the purchasing power of consumers, impacting major sectors such as automobiles and real estate. Consumers, particularly those interested in purchasing cars or homes, have found their ability…

- Business News

Bank of Thailand faces political pressure to cut interest rates

The Bank of Thailand (BoT) is under increased political tension to reduce interest rates, with the majority of analysts predicting that the monetary authority will withstand requests for unexpected easing to bolster the economy. This escalating discord between Prime Minister Srettha Thavisin and the central bank concerning monetary policy direction is predicted to damage investor confidence, though the likelihood of…

- Business News

Thailand PM calls for cut in interest rates amid economic crisis

The Prime Minister and Finance Minister of Thailand, Srettha Thavisin, urgently called upon the Bank of Thailand (BoT) to organise an unscheduled meeting of its Monetary Policy Committee (MPC). The objective of this meeting is to consider a cut in interest rates, as recent data suggests that the nation’s economy is in crisis. PM Srettha’s plea for this urgent meeting…

- Business News

Chamber of Thailand calls for cut in interest rates to boost recovery

The Thai Chamber of Commerce (TCC) expressed its expectations for the Bank of Thailand to consider a reduction in interest rates in its forthcoming meeting. The TCC argues that although the economy is on a recovery trajectory, it remains susceptible to various challenges. Sanan Angubolkul, the chairman of the chamber, acknowledged the decisions made by the Monetary Policy Committee (MPC)…

- Business News

Thai government and central bank clash over interest rates

The ongoing discord between government officials and central bankers regarding interest rate adjustments is creating uncertainty for local banks and could potentially trigger further foreign investor withdrawals. Thailand Prime Minister Srettha Thavisin, along with key advisors, is advocating for a reduction in rates by the Bank of Thailand (BoT) to stimulate an economy the Thai PM describes as being in…

- Business News

Pressure mounts on Bank of Thailand to reduce high interest rates

Thailand Deputy Finance Minister Julapun Amornvivat expressed concern that the country’s current interest rates are excessively high, putting strain on citizens’ disposable income and stunting the nation’s economic growth. This stance encourages the Bank of Thailand to reconsider its monetary policies. “The Thai people’s spending power is in jeopardy due to these high rates. I hope the Bank of Thailand…

- Business News

Bank of Thailand confident in limited corporate bond rollover risk despite rising interest rates

Despite rising interest rates, the Bank of Thailand has expressed confidence in the limited risk of corporate bond rollover this year, stating that it should not pose a significant threat to systemic risk. The local bond market has remained functional, with private businesses continuing to secure new funds. Sakkapop Panyanukul, the senior director for financial markets at the central bank,…

- Business News

JSCCIB urges BoT to cut high interest rates amid economic threats

As the economy grapples with internal and external threats, the Joint Standing Committee on Commerce, Industry and Banking (JSCCIB) called on the Bank of Thailand (BoT) to reduce interest rates. The high interest rates are causing a surge in borrowing costs, amidst a volatile recovery due to the global economic downturn. These views were expressed by Sanan Angubolkul, chairman of…

- Business News

Thai PM and central bank clash over interest rates amid low inflation

The clash between Prime Minister Srettha Thavisin, who also holds the Finance Minister portfolio, and the Bank of Thailand (BoT) intensified. The prime minister has been vocal about his belief that the central bank should lower its interest rates as inflation rates have decreased. On a social media platform, PM Srettha blamed the BoT for causing harm to the economy…

- Business News

Thai stocks fall 1.3% amid fears of high interest rates impact

Share prices experienced a surge on Friday, reversing earlier downtrends and Wall Street’s sell-off, as traders weighed the implications of further interest rate hikes by central banks grappling with inflationary pressures. Thai stocks fluctuated between 1,503.23 and 1,539.40 points before ending yesterday at 1,522.59, marking a 1.3% fall from the previous week, with daily transactions averaging 52.06 billion baht. Retail…

- Business News

Fed’s high interest rates outlook spooks Thai stock market investors

The hawkish stance of the Federal Reserve on maintaining “higher for longer” interest rates is projected to keep the Thai stock market in bearish territory. This comes as elevated rates pose a threat to global economic recovery, leading to consistent fund outflows from the Stock Exchange of Thailand (SET). Despite the expected decision by the US central bank to retain…

- Business News

Global investors navigate high interest rates amid inflation control efforts

Amid recession concerns, inflation, and high interest rates, investors seek promising investment avenues. Stock enthusiasts believe global interest rates are close to peaking, while central banks watch inflation. The US Federal Reserve raised the federal funds rate to 5.25-5.50% in July, the highest in decades. The European Central Bank increased rates by 0.25%, and the Bank of Japan hints at a…

- World News

US Federal Reserve poised to raise interest rates for inflation control

The chairman of the US Federal Reserve, Jerome Powell, announced last Friday that they are prepared to increase interest rates further if needed. The central bank aims to maintain high rates until inflation approaches its 2% target. Powell highlighted that despite the recent decline of inflation from its peak, it remains excessively high. In his address to the annual symposium of…

- Business News

Bank of Thailand anticipates slower loan growth: Interest rates not main factor

The Bank of Thailand anticipates a slower pace of loan growth in the banking industry due to reduced demand, while asserting that rising interest rates are not the main factor impacting loan expansion. The central bank’s soft loan programme, which aimed to aid small and medium-sized enterprises, largely contributed to the increased borrowing during the post-pandemic recovery period. Sakkapop Panyanukul,…

- World News

Fed holds interest rates steady amid persistent inflation concerns

The Federal Reserve has opted to keep interest rates steady, marking the first time in over a year that it has not increased them. The decision, which holds the benchmark rate between 5% and 5.25%, allows officials time to evaluate the impact of ten prior rate hikes since March 2022. These measures were implemented in an attempt to control inflation.…

- Business News

Thai interest rates raised to 2% by BoT amid core inflation worries

The Monetary Policy Committee of the Bank of Thailand (BoT) anticipates ongoing economic growth with some potential risks, as evidenced by their decision to increase the key Thai interest rates for the sixth consecutive meeting, according to the minutes released recently. On May 31, the committee unanimously agreed to increase the one-day repurchase rate by a quarter point to 2%,…

- Business News

Impact of higher interest rates on Thai businesses and homebuyers

Concerns are rising among industry leaders that higher interest rates could negatively impact businesses, particularly small ones, and weaken the purchasing power of homebuyers. The Bank of Thailand’s Monetary Policy Committee recently voted to raise the policy rate to 2.00% from 1.75%, prompting state and private banks to follow suit. The Federation of Thai Industries (FTI) warns that higher interest…

- Business News

Thai state banks raise interest rates after central bank policy hike

Following the Bank of Thailand‘s recent policy rate increase, state banks, including the Government Savings Bank (GSB) and the Bank for Agriculture and Agricultural Cooperatives (BAAC), have raised interest rates for loans and deposits, with deposit rates exceeding loan rates. Vitai Ratanakorn, GSB’s president and chief executive, stated that after the central bank’s policy rate increased by a quarter percentage…

- Business News

Rising interest rates boost mortgage NPLs, Bank of Thailand urges debt restructuring

In the first quarter of this year, non-performing mortgage loans (NPLs) experienced an increase due to rising interest rates, prompting the Bank of Thailand (BoT) to encourage banks to assist borrowers through debt restructuring. The central bank recently revealed a housing loan NPL ratio of 3.16% in the commercial banking system, up from 3.01% in the previous quarter. The primary…

- Business News

Financial institutions step up to help mortgage customers amid rising interest rates

Financial institutions are taking steps to assist mortgage customers in coping with increasing rates as Central Bank hikes impact floating mortgage interest rates. Thakorn Piyapan, president of TMBThanachart Bank (ttb), mentioned that the bank provided some mortgage clients with the option to raise their monthly debt repayment amount or prolong the loan period to alleviate the higher monthly debt burden…

- Economy News

Bank of Thailand increases interest rates, again!

The Monetary Policy Committee (MPC) of the Bank of Thailand insists that it had to hike its policy interest rate by 0.25% to 1.50% yesterday for the fourth consecutive time to curb high inflation. MPC Committee Secretary Piti Disyatat reported that the committee was unanimous in its decision. “Under a gradual policy normalisation, rate hikes could take place for a…

- Property News

SET-Listed Thai Developers Sought For Interest Rates Cut

Sena Development Plc and Sansiri Plc, two developers with SET listings, will speak with banking institutions in an effort to lower the interest rate on mortgage loans for purchasers of energy-efficient homes sale in Thailand, estimated between 0.5% and 1% in the first half of the year 2023. Sena Development’s managing director, Kessara Thanyalakpark, asserted that financial assistance in the…

- World News

US Federal Reserve hikes up interest rates again

The United States Federal Reserve approved yet another aggressive interest rate hike yesterday in their quest to combat persistent inflation which is at a 40-year high in America. It is the fourth consecutive 0.75% interest rate hike approved this year. The central bank has raised the policy rate from near zero in March to what is now between 3.75-4%. It…

- Business News

Finance: Rising interest rates won’t kill REITs

PHUKET: Many investors looking for yields and exposure to real estate have piled into Real Estate Income Trusts (REITs) despite the prevailing investment wisdom being any eventual rise in interest rates will be a disaster for the sector. After all, REITs rely heavily on borrowing to acquire real estate with interest payments on this debt usually being their biggest expense.…

- Business News

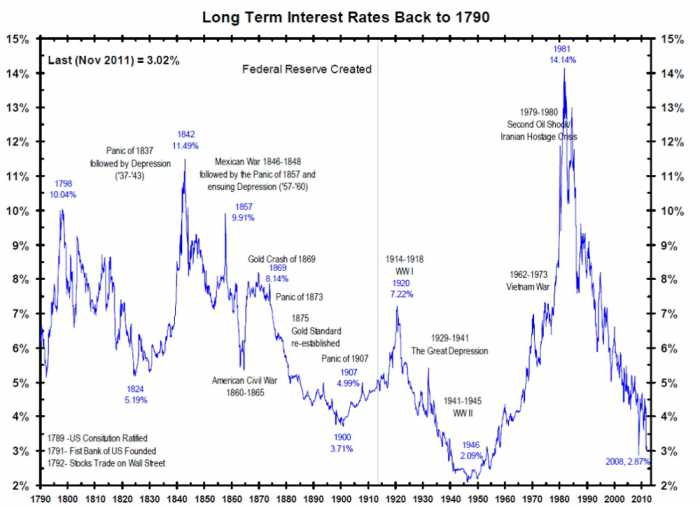

What to do when interest rates rise

PHUKET: IT IS widely believed that history does indeed repeat itself. What was true in the past is most likely to be true today and in the future. Sure, the events and names of companies change, but general economic principles will apply. When it comes to investing, one of the most important things for investors to understand is long-term interest…

- Phuket News

Thai banks slash interest rates for foreigners

PHUKET: Thai banks here and across the country have quietly followed the legions of tuk-tuk drivers and street vendors who practice “two-tier” pricing – one for Thais and another for foreigners. In this case, the pricing relates to interest paid on savings accounts and fixed deposits. While the rates paid to foreigners vary from bank to bank, almost all are…

- Thailand News

Interest-ing development: Ministry slashes housing loan rates

The Ministry of Social Development and Human Security announced a significant reduction in housing loan interest rates by 0.5% for one year, aiming to support citizens during challenging economic times. Minister of Social Development and Human Security, Varawut Silpa-archa revealed this decision at a press conference at Government House at 10am today, May 28. The Community Organisations Development Institute (CODI)…