Phuket Business: Get your head in the clouds

PHUKET: Information technology (IT) has dramatically changed the way people communicate and do business. Changes in information technology are rapidly taking place and investors who are able to spot the newest trends can profit from those trends greatly. One continually evolving trend is “cloud computing”.

Investors focused on IT growth stocks and exchange-traded funds (ETFs) have several options when it comes to investing in this sector.

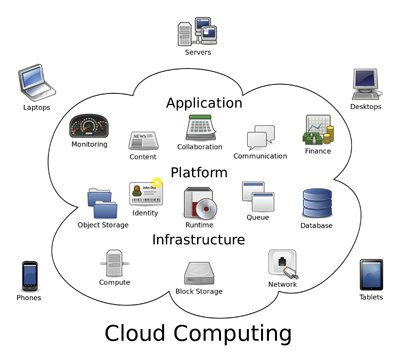

First, let us define “cloud computing”. When you think of cloud computing, think of Google or Yahoo! mail, the Web-based email messaging services that allow you to use the software and hardware resources of those companies at no cost.

These Web-based applications use remote servers, which may be housed anywhere in the world. In addition to free public email accounts as examples of cloud computing, you may have also used other internet-based applications, such as Google Docs. These applications provide free software, server space, or platform infrastructure to create and share your work online.

On Google Docs you can create, manage, and access presentations, spreadsheets and other documents from anywhere in the world in real time.

This means that cloud computing services are available on demand, provide a wide network access and have an elastic scale. Public cloud computing has revolutionized the way people and businesses use the Internet to create, store, and manage their data.

However, it has also become an effective way to reduce investment and overhead costs for corporations and public institutions. As businesses and public institutions continue to seek ways to cut costs, cloud computing appears to be an excellent solution to achieve efficiency. However, this will require cloud computing providers to ensure a high degree of integrity and security for the information managed or stored on a shared network.

For example, Google views its ‘high-security’ reputation as a key determinant of success. Some companies apply international security standards (ISO27001), which provides for a third-party audit. Others adhere to the principles governing security of information and network systems under the standards of the Organization for Economic Development and Cooperation (OECD).

With all this in mind, higher demand for cloud computing will be a major boom for private-sector providers who can provide a high level of integrity and supplement it with appropriate resource support services. Cloud computing has already experienced exceptional growth. Gartner Inc sees the cloud service market growing in compounded rates by 16.85% annually through 2014. This will boost cloud computing revenues to US$148.8 billion by 2014. That represents a cumulative increase of more than 217%. More than half of the cumulative revenues will accrue to the US Market.

So, how do you take advantage of this growth? Three stocks, namely Oracle (Nasdaq: ORCL), BMC Software (Nasdaq: BMC), and Informatica (Nasdaq: INFA), look best positioned to benefit from the high growth in the sector. The three companies provide a combination of public and private cloud computing services. They all have low debt-to-equity (D-E) ratios; in fact, Informatica is debt-free.

This assures that the three prospective winners in the sector are not burdened by excessive credit that could stifle their growth prospects.

While their P-E (Price to Earnings) ratios may look relatively high compared to those of some other IT companies, revenue and earnings growth expectations make them appealing.

What’s more, they have teamed up with similar companies: Oracle with Amazon and BMC Software with salesforce.com, so as to achieve synergies that can assure robust growth.

For investors who prefer a broad exposure to the sector, there is the Vanguard Information Technology ETF (VGT), with a broad exposure to the IT sector, including Oracle as one of the fund’s largest holdings.

Another ETF, which tracks the Dynamic Networking Intellidex Index and contains many cloud computing stocks, is PXQ- PowerShares Dynamic Networking.

It is comprised of networking stocks and is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including fundamental growth, stock valuation, investment timeliness and risk factors.

As of November 5, the top holdings are: Citrix Systems, Amphenol Corp, F5 Networks, Vmware, Juniper Networks, Symantec, Cisco Systems, Opnet Technologies, Motorola Solutions and Qualcom.

Investing in cloud computing is investing in the future of the web-based information technology. That future is now and taking part in it may prove to be a good investment choice for many investors.

Don Freeman is President of Freeman Capital Management, a Registered Investment Advisor with the US Securities Exchange Commission (SEC). He provides personal financial planning and investment advice to expatriates and teaches financial courses across SE Asia and the United States. For more information visit: freemancapital.net or call +66 (089) 970-5795.

— Don Freeman

Join the conversation and have your say on Thailand news published on The Thaiger.

Thaiger Talk is our new Thaiger Community where you can join the discussion on everything happening in Thailand right now.

Please note that articles are not posted to the forum instantly and can take up to 20 min before being visible. Click for more information and the Thaiger Talk Guidelines.

Leave a Reply

You must be logged in to post a comment.